Thursday, April 30, 2009

PEST Analysis

Political factors examine how and to what degree a government participates and intervenes in the economy. Specifically, political factors include areas such as tax / subsidy policy, labour laws (minimum wage, safety regulations etc), environmental regulation, trade barriers and tariffs, and political stability. Furthermore, governments have great influence on the health, education, and infrastructure of a nation.

Economic factors include macro-level economic factors such as economic growth (GDP), interest rates, exchange rates, the inflation rate and unemployment rate. For example, interest rates affect a firm's cost of capital and therefore to what extent a business grows and expands. Exchange rates affect the costs of exporting goods and the supply and price of imported goods in an economy.

Social factors include the culture, education level, health, population growth rate, and age distribution. Trends in social factors affect both internal and external factors in the company including the demand for a company's products or services (what the public in that geography demand) and how that company operates (who is available to be hired from the pool of workers).

Technological factors include R&D activity, automation, the rate of technological change as well as the current state of technology (i.e. communications infrastructure). They can determine barriers to entry (patent law) or provide strategic leverage.

By looking at all these factors, an analyst can determine the relative attractiveness of looking at different geographies from a macro-perspective. From a top-down approach to strategic thinking, a PEST analysis is a rudimentary starting point for any decision making.

Wednesday, April 29, 2009

Urban Planning and the Irony of Mass Transit

Particularly, with a mildly satirical tone, I wanted to look into the phenomenon of clustering. In other words, I wanted to answer two questions:

- "Why do I always seem to miss buses in pairs?", and

- "Every time I try to ride the bus, why do I always get the full one?"

To understand what I mean, let's assume:

To understand what I mean, let's assume:- A bus route to a main station has five equally distanced stops A, B, C, D and E.

- The distance between stops (described as time to traverse from one stop to another) is 2 minutes irregardless of traffic and other factors.

- It takes 2 minutes to load a bus at each stop regardless of number of passengers, unless there are no passengers (or the bus is full) in which case the bus travels "express mode" and doesn't stop at all.

- A bus can hold 50 people maximum.

- That each stop has 15 people (total 75). It will take 2 buses to pick up all the passengers.

Notice that whatever the interval between buses (say 15 minutes) is the minimum wait time that the passengers at D and E have to wait for the second bus (on top of normal travel time if they could get one bus 1).

The travel time for each group is as follows:

Bus 1 (containing Passengers from A, B, C and 5 from D) arrives at the terminal after 18 minutes

Time = 2 min per stop x 4 stops

+ 2 min drive time between 5 stops

Bus 2 (containing the remaining passengers from from D and E) arrives at the terminal after 29 minutes

Time = 2 min per stop x 2 stops

+ 2 min drive time between 5 stops

+ 15 minute delay between Bus 1 and 2

Generally,

Travel time for any given bus = time spent picking up passengers (delay per stop x number of stops)

+ time spent driving between stops (travel time per stop x number of stops)

+ time delay between buses (anticipated wait time for a passenger who 'just missed the bus')

Notice that in this model, a bus that follows another will have a more "efficient route" excluding the delay time between the buses (currently set at 15 minutes) if the delay is less than 11 min, Bus 2 arrives before Bus 1! This is because Bus 1 (assumed to have "first dibs" on the passengers) will be held up in "transactions" picking up passengers.

Scenario ii What would happen in an incremented step by step analysis (if the two buses left at the same time) is as follows:

- Bus 1 picks up all passengers at A (2 min) while at the same time

Bus 2 travels to stop B (4 min). - Bus 2 picks up all passengers at B (2 min) while at the same time

Bus 1 travels to stop C from A (4 min). - Bus 1 picks up all passengers at C (2 min) while at the same time

Bus 2 travels to stop D from B (4 min). - Bus 2 picks up all passengers at D (2 min) while at the same time

Bus 1 travels to stop E (4 min). - Both buses run "express" to the terminal

Both Buses 1 and 2 arrive after 12 min (they share the load equally). This is what happens during non-rush hours and I would describe as "clustering", the phenomenon where buses (even when they start at different times) start to travel together.

As you can tell, this is a horrible situation when it comes to urban planning. For most lines, this means that even if you deliberately stagger buses so that they are 15 minutes apart (assuming that this is also the minimum amount of time someone would have to wait between buses), the truth is that with clustering on non-rush hours it is more likely the wait will be double that (because one bus will naturally catch up with the other if there isn't enough traffic). Hence the answer to: "Why do I always seem to miss buses in pairs?" is because they have a natural tendency to cluster.

Also, implementing queuing and network traffic theory, you can use the analogy that each bus stop is a server node and each bus is a service arrival.

This shows, as in the first scenario (Scenario i), that buses that lead are full. Assuming that occasionally when a few people get off at later stops (rather than waiting for the terminal) this is the only circumstance when a bus frees up more capacity to take on more passengers (also why they ask people to leave from the rear and board from the front). Hence the answer to: "Every time I try to ride the bus, why do I always get the full one?" is because during rush hour, most buses are full to capacity and only buses with marginal capacity available (almost full) stop to pick up more passengers.

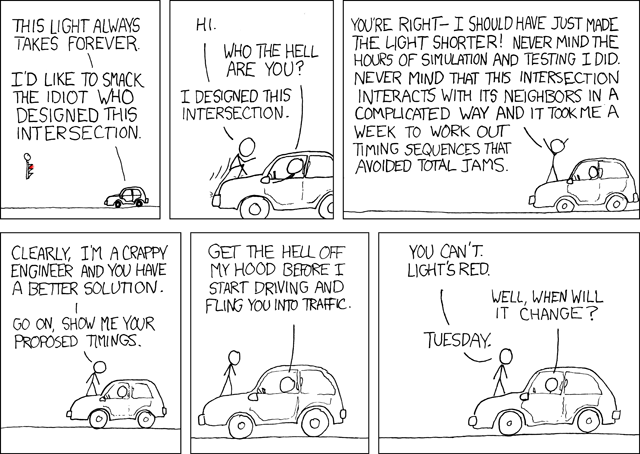

Now the system described here only describes an oversimplified one line system. Imagine multiple inter-related lines, time sensitive with daily cyclical traveler arrival patterns, complicated with traffic congestion, traffic lights, construction and other "features" interacting on the road. You certainly can't just throw more buses into the system if you want to improve performance. And we can certainly sympathize with both the Traffic Engineer as well as the person in the car in this xkcd comic:

Monday, April 27, 2009

Michael E. Porter's Five Forces - Industry Competitive Analysis

Porter's five forces analysis looks at:

Another way of looking at this is a 360 view around your company's position in an industry. This includes your supply chain (vertical view of suppliers and customers) as well as within your market (horizontal view of entrants and substitutes). Each of Porter's four mutually exclusive forces contribute to the over all competitive rivalry in an industry.

Another way of looking at this is a 360 view around your company's position in an industry. This includes your supply chain (vertical view of suppliers and customers) as well as within your market (horizontal view of entrants and substitutes). Each of Porter's four mutually exclusive forces contribute to the over all competitive rivalry in an industry.This helps you answer the question, "Should we start a new venture in this industry?"

Let's have a closer look at each category:

The threat of substitute products The greater the number and the closer substitute products imply an increase the propensity of customers to switch between alternatives (high elasticity of demand).

- buyer propensity to substitute

- relative price performance of substitutes

- buyer switching costs

- perceived level of product differentiation

The threat of the entry of new competitors Inefficient or overly profitable markets will attract more firms and capacity investment. More capacity results (for under served markets) results in decreasing profitability. The markets will always seek equilibrium even if that equilibrium is artificially imposed by barriers.

- the existence of barriers to entry (patents, rights, etc.) - Note the expiry of patents can trigger new a equilibrium and competition rivalry movements in the industry

- size - capital requirements and economies of scope

- brand equity

- access to distribution

- learning curve advantages - required skill

- government policies, regulations and licensing requirements

The bargaining power of customers Also described as the market of outputs. The ability of customers to put the firm under pressure and it also affects the customer's sensitivity to price changes.

- buyer concentration to firm concentration ratio

- degree of dependency upon existing channels of distribution

- bargaining leverage, particularly in industries with high fixed costs

- buyer volume

- buyer switching costs relative to firm switching costs

- ability to backward integrate - can customers do this themselves?

- availability of existing substitute products

- buyer price sensitivity

- differential advantage (inimitable characteristics) of industry products

- supplier switching costs relative to firm switching costs

- degree of differentiation of inputs

- presence of substitute inputs

- supplier concentration to firm concentration ratio

- employee solidarity (e.g. labor unions)

- threat of forward integration by suppliers relative to backward integration by firms

- cost of inputs relative to selling price of the product (profit margins)

The intensity of competitive rivalry For most industries, this is the major determinant of the competitiveness of the industry. Sometimes rivals compete aggressively and sometimes rivals compete in non-price dimensions such as innovation, marketing, etc.

- number of competitors

- rate of industry growth

- intermittent industry overcapacity (like the service industry)

- exit barriers

- diversity of competitors

- informational complexity and asymmetry

- fixed cost allocation per value added

Each of these sections are scored and collectively analyzed to understand the competitive forces in any given industry. This framework highlights the key factors which determine any industry's overall competitive rivalry (and attractiveness). Industries which are not competitive may be attractive for other companies to enter (or increase investment), industries which are overly competitive may force out weaker companies and would generally be unattractive for new ventures.

Sunday, April 26, 2009

How We Decide, by Jonah Lehrer

However, Jonah eventually starts to venture into new ground when he begins discussing moral decision making.

His highlights the key take aways of his book, the most important being to "think about thinking":

Whenever you make a decision, be aware of the kind of decision you are making and the kind of though process it requires.Specifically:

- Simple problems require reason.

- Complex problems benefit (ironically) emotional decisions.

- Novel problems require reason - analyze underlying patterns to find solutions.

- Embrace uncertainty - deliberately contrarian hypotheses to avoid discounting uncomfortable yet material facts.

- You know more than you know (paradoxically) - emotions may often be hard to analyze, but they can provide a wealth of information if you know how to use them and when to trust them (and what their limitations are).

- The best decision making requires analysis and emotions and the best decision makers will have a mixed approach, knowing when to use which.

Sent from my BlackBerry device on the Rogers Wireless Network

Thursday, April 23, 2009

SWOT Analysis

Another way of looking at a SWOT analysis is a 2 x 2 matrix. Strengths and weaknesses are generally internal factors, Opportunities and Threats external. Strengths and Opportunities are positive aspects and Weaknesses and Threats are negative.

This is a great structure to apply to make team members more aware of the current context for decision making and setting direction.

This is a great structure to apply to make team members more aware of the current context for decision making and setting direction.Strengths

- What is our area of expertise?

- What is our inimitable difference?

- What are we recognized and associated with?

- What are the key factors in driving our brand equity?

- What can we improve?

- Where is the largest number of systematic failures?

- Who are our biggest critics and what are they focused on?

- Are there additional growth sectors in the market?

- Can our products and services be applied in other areas or have other uses?

- What are our processes dependent on?

- What risks are associated with our business?

- What is the probability of disruptions from external events?

- How can we leverage our Strengths?

- How can we improve each Weaknesses?

- How can we benefit from each Opportunity?

- How can we mitigate each Threat?

Other methodologies that pick up after a SWOT analysis include matching and converting.

Matching uses competitive advantage to pair strengths with opportunities.

[Case Study] Starbucks is very well known for it's coffee, but it didn't become a huge success overnight. Upon analyzing their business models, Howard Schultz understood that what they were selling was more than just coffee, but an experience. By leveraging the Starbucks expertise in coffee, he was able to extend the brand offering to "re-creating the Italian coffee-bar culture in the United States [as] Starbucks' differentiating factor".

Converting means converting weaknesses or threats to strengths or opportunities.

[Case Study] A threat McDonald's position in the wake of movies such as Super Size Me was a movement towards healthier living where McDonald's was decidedly not well positioned.

However, McDonald's is the world leader in standardized food preparation services, having pioneered the field in the 50's under Ray Kroc. With an opportunity in the growing healthy foods space, McDonald's leveraged it's strength and food processing skills to provide a new repertoire of products well outside their original hamburger mandate. Their product line retained their strength of delivering cheap convenient food (their hallmarks) while entering a new and growing market space.

Wednesday, April 22, 2009

Case Study: Manufacturing Capacity, Opening a New Factory

Salience: There are many factors which are important in making this decision. For instance, how much capacity is required after the proposed changes? What is the distribution network needs based on geography? What is the cost of the factors of production (land, labour, capital) associated with different locations?

Causality: With the goal of optimal operations to achieve maximum profitability, each of these factors will have a different effect on how you make your decision. In closing an old plant, you will have to do a cost / benefit analysis of each plant and determine which one makes the most sense to shut down. The following framework can be adapted to better understand the closing of one factory to the entire manufacturing load and network.

In the scenario of opening a new plant, you technically have more flexibility in terms of which locations where you want to open (including even outsourcing capacity from others) so we can start to build a framework about how to decide what consitutes an optimal solution.

Architecture: There are many factors to consider in a holistic approach.

- Geographic capacity demand.

- Distribution of products.

- Local labour, material and transportation costs.

- Resource availability.

- n is the number of current factories in operation

- R is the optimal vector of your new factory location

- Vi is the vector describing the locations of your relevant capacity factors.

- Qi is a weighting applied to the relative capacity impact of each location (a positive value implies a customer demand, a negative value implies a factory capacity supplied). This factor can also be scaled for other factors accordingly.

- i is a counter variable iterating from 1 to n (encompassing all elements affecting capacity)

Now, what if you only have a limited number of possibilities because of such factors as labour and resources are limited to big city areas etc? You need to match the profiles of your possible solutions to your "optimal" solution. However, in looking at your optimal solution, perhaps it will provide you with a potential solution that you had not previously considered (locating in a different town for instance).

Resolution: Although this is a very reasonable methodology, it only provides a mechanical answer based on the inputs provided and requires the analysts to accurately gauge the weight and importance of each individual factor. There may be many other influences such as political pressure to locate in a particular area. However, it acts as a logical framework for identifying the value of different locations while considering the broadest and more relevent factors relating to the capacity management decision.

[Case Study] A consulting company has 5 equally skilled consultants in the same field. 2 are in New York, one lives in Boston, MA and one in Philadelphia, PA. Their business is as follows is divided geographically as follows:

- 20% Philadelphia

- 50% New York

- 30% in Boston

Assume that each consultant is equally effective and the work is divided evenly. Also, the last consultant is more flexible to travel (but all consultants generally want to travel as little as possible), where should the last consultant reside?

Assume that each consultant is equally effective and the work is divided evenly. Also, the last consultant is more flexible to travel (but all consultants generally want to travel as little as possible), where should the last consultant reside?Using the formula above, what is the optimal location for the last consultant to reside?

[Answer: Hartford, Connecticut. Reasoning: Each consultant reflects 20% of the work load. This means that the consultant in Philadelphia can deal with the work load there. Two of the NY consultants reduce NY's capacity deficiency to 10% as does the consultant in Boston. Another way to look at the solution is that the only work left for this last consultant is equally split between New York and Boston.

The so in calculating the center of gravity, we learn that the optimal location solution is equidistant from New York and Boston (Hartford) - Note that Hartford was not a suggested location, but came up in the investigation.

Also note that the assumptions were just for simplicity in illustrating the solution, but the differences of the contributions, demands and travel costs of each individual component can be mathematically weighted against the whole - Philadelphia has more work demand than Boston, Senior Consultants do more work, costs for junior consultants is cheaper etc.]

Tuesday, April 21, 2009

Measuring Competitiveness - The Herfindahl-Hirschman Index

First, look at the different models available for describing a market place (in decreasing competitiveness): Perfectly competitive, monopolistic competition, oligopoly, and monopoly.

Looking at the extreme cases, we would expect a company in a perfectly competitive industry would have an insignificant market share (mathematically represented by an infinite number of firms with an infinitesimal market share). A monopoly would only have one firm will all the market share.

How can we use an index to describe the competitiveness of the intermediate competitive states? Number of firms is one option, however it needs to incorporate the relative market share for each.

Now let's return to the formula for HHI:

- Xi is the percent market share of firm i x 100

- n is the number of firms (or 50 if more than that)

Also, why choose a limit of 50 firms? Why place any limit at all? Well first of all, for every 50 firms, each additional firm contributes less than 2% (remember that firms are added from largest to smallest) and therefore affects the HHI less and less (less than 4 points out of a possible 10k). This was probably put in as a computational limit in order to simplify calculation. There is very little precision or accuracy lost by discounting remaining firms beyond 50.

An economically and mathematically perfectly competitive market will have an HHI of near 0 (in theory only, as a nearly perfect competitive market with 100 firms with 1% will still have a score of 100). A maximum HHI score (indicating a monopoly) occurs at 10,000.

The CFA text book proposes the following HHI metrics for the various competition levels:

- Perfect Competition less than 100

- Monopolistic Competition 101 to 999

- Oligopoly 1,000+

- Monopoly 10,000

- Competitive less than 1000

- Moderately competitive 1000 to 1800

- Uncompetitive 1800+

Monday, April 20, 2009

Supply Chain Management - The Vertical Integration Decision

Well as it turns out, there are very heavy capacity implications when making acquisition decisions up the chain. Each layer of the supply chain adds value (and challenges) in unique ways. What are the key metrics for creating a compelling case for vertical integration? If your organization:

- needs more control over your supply chain management (planning, synchronization, JIT inventory practices)

- requires a greater degree of customization not currently available through third parties

- has the capacity demand to generate your own economies of scale (lower costs)

- can experience growth and efficiency and capture synergies in the new vertical integration

Vertical integration can either be backwards (up the supply chain) to encompass inputs or forwards (down the supply chain) to encompass distribution channels.

What are the challenges to vertical integration? Each layer reflects a value added component and therefore is fraught with its unique challenges such as market sizing, competitiveness, industry regulations etc.

However, as a word of caution companies that do forward integrations (cutting out the "middle man") are often in danger of venturing into unknown territory as well as damaging relationships with other distributors (who can see this move by a company as repositioning from cooperative to competitive). This is exactly what happened between Harlequin and Simon & Schuster in the late 70's.

[Case Study] Today, Pepsi Co has put a set a $6 billion bid to acquire two of it's largest independent bottlers for Pepsi Bottling Group and Pepsi Americas. In this particular case, the decision for vertical acquisitions was driven by the need to gain a strategic advantage through controlling over 80% of their distribution. Each of the acquired companies shares are currently valued at 17% over their Friday closing price.

International Marketing - Pitfalls of Translation

My favourite is the mistranslation of semi-formal as "demi-habillé" (or half dressed). As a result, the Quebecois, in a good natured attempt to remind English speaking Canadians of the importance of translation, collectively came to the semi-formal event literally half dressed in a shirt or blouse and boxer shorts (other more "creative" Quebecer's choose which half to dress up). Now at all semi-formal events, they come continue to come "demi-habillé". The proper translation for semi-formal is "tenue de ville".

While these mistranslations were embarrassing, we weren't alone in a few other disastrous mistranslations of advertising slogans by public entities.

With the recent 2008 Olympic games in China, I was fairly happy with some of the Mandarin translations of foreign products including:

- Coca Cola translated in Chinese to "Delicious Happiness".

- BMW is translated in Mandarin as Bao Ma (literally "valuable horse"). It also doesn't hurt that "Bao Ma" is a useful phonetic equivalent of the slang "Beamer".

This is also the case with certain lucky numbers and images in Chinese culture. For instance, the word for the number 4 sounds an awful lot like death and is therefore associated with bad luck. The number 8 is prosperity associated with fortune. The traditional Chinese new year greeting "Gong hei fat choi" contains the word "fat" sounding like 8. Without an intimate knowledge of the language and context, Babelfish style translations (replacing words with literal translations and with a rudimentary understanding of grammar) are sure to run awry.

Quantifying The Value of Trust - Assigning a Value to the Intangible

What had initially started off as a conversation about the mechanics of importing and financing (supply chains, letters of credit, customer relationships etc) eventually wandered into the realm of how to value trust.

It began with my colleague outlining the various incremental stages of an international supply chain relationship:

- New relationship. You don't know the supplier and the supplier doesn't know you. Although you both require each others services, you need to be sure that the other party won't default on their side of the transaction. You bring in banks (or government trade institutions) in order to secure financing and guarantees with an irrevocable letter of credit for the payables (supplier / exporter) and the appropriate shipping documentation for the receivables such as the bill of lading (importer).

- Mature relationship. You have conducted business with the supplier previously and are more familiar with the terms of delivery and credit. While perhaps there are not as many requirements necessary for insurance type guarantees against default, there is still the need for appropriate financial transactions. The banks are still involved in currency conversions and transactions.

- Intimate relationship. Payment and shipping terms can be adjusted according to needs of both parties with minimal (if any) intervention by intermediaries. This improves cash flow as well as just-in-time / economies of scale related inventory needs and has a built in stress tolerance against default.

For instance, between stages 1 and 2, the monetary value of the improved relationship and trust can be approximated by the reduction of cost associated with no longer requiring intermediaries such as banks to provide services to insure and guarantee the transaction. This can become quite sizable as the fees associated with these services are not insignificant. You are essentially paying banks to manage risk for you.

Between stages 2 and 3, the monetary value is a bit less obvious, but still applicable. For instance, financing costs with deferring payment can be calculated as the marginal cost of capital required to reorganize the payment schedule. The cost of financing to improve cash flow is also not marginal relative to the overall costs of the transaction (usually a sizable percentage).

In this way, it is easier to put a price tag on something intangible by looking at the opportunity cost of the alternatives and the financial outlays associated with each. It also quantifies the investment in your relationship with suppliers (or customers) to see what the hidden costs were to arrive at these more optimal arrangements.

Sunday, April 19, 2009

Jack and Suzy Welch, Winning

to describe the mechanics of success

so that anyone can understand."

Jack is an avid crusader against unnecessary bureaucracy and management layers in favour of flexibility and ownership as a mechanism for empowerment. The ideas he puts forth in his books expounds his philosophy that direct communication and quick action in its various forms are the key to success in a variety of different operational functions.

While hardly a new book, it is one of my favourites. Jack deals with a broad range of topics, each of which is still relevant (sadly) today. Some of my favourite topics discussed are:

- Candor - direct and clear communication of unpleasant (but necessary) topics in the search for solutions

- Differentiation - the acknowledgment and rewarding of good work and values and the correction of poor behaviours (a natural corollary to candor)

- The hiring batting average - holding recruiters responsible for building an organizational culture around performance

- Divesture and parting ways - dealing with issues of strategic and systematic non-performance in organizations and individuals

- Six-sigma - Understanding the value of consistency. Literally in statistics: reducing the variance of output to encompass six sigmas (standard deviations) - a *very* narrow band in any field

- Ownership in career management - taking responsibility for advancement through adding value and understanding your role

Sent from my BlackBerry device on the Rogers Wireless Network

Thursday, April 16, 2009

Using Oligopolies and Monopolies to Model Union Behaviour

While it should hardly be a surprise that organizations and individuals look out for their own best interests, why is it permissible for some to exhibit behaviours that would be considered illegal by others?

What do I mean? Unions are essentially collaborating (colluding) with each other in order to capture as much of the labour market as possible across different industries. Whatever sectors they have influence over will usually experience inflated costs. If any business ever did that, they would be struck with anti-trust and anti-competition legislation.

Now any intelligent person will immediately point out that people should not be treated in the same way as oil. Of course not. However, the fruits of their labour can be quantified as a wage and to stray too far from that natural intrinsic value is poor practice.

Don't get me wrong. I don't think labour should be under paid. That scenario is just as unstable (and disastrous). But please don't act surprised or insulted when there is an inevitable reckoning when a scenario demanding more competitive practices force dramatic changes. Inefficient and unfair practices, whatever form they take, are inherently unstable. This is currently the scenario with Fiat purchasing Chrysler but incredibly weary of union wages inflated above the industry norm.

The difference between a union and good management is that good management should adjust wages as close as possible to their intrinsic value (up or down). Bad management will always try to under cut and unions will always try to get more. Its ironic (and extremely unfortunate) that in unions often start (and perpetually persist) in companies that at one time or another exhibit bad management practices regarding labour. Resulting in extravagant tug-of-wars in which no one really wins.

The best way to keep a union out? Be a responsive, flat and flexible management. Pay your staff well, respect them and be sensitive to their needs so they don't feel like they need an "additional management layer / political structure" to take membership dues in order to insulate them from poor management. A scenario where you regularly pay dues requires you to regularly justify your use of those fees (as any accountable organization should) and the situation naturally becomes resistant to change as unions are required by their mandates to always fight for higher wages even if the situation does not permit it (this is due to the zero-sum non-efficient use of membership fees to capture labour "demand surpluses" of businesses).

Regarding my previous model of profit per employee, I think that there should also be a risk / reward model when applied to wages for jobs. This is in direct response to critics who see CEO's with large compensation packages who leave sinking ships. I firmly believe (as do our capital markets) that if you want higher rewards, you must take more risks. The golden parachutes provided to CEO's seem to defy this logic. Certainly another example of an unstable scenario that doesn't "feel right".

Wednesday, April 15, 2009

Story of Stuff - Sustainability and Statistics

I was recently introduced to this interesting video on the history of stuff (~21 min) and thought it might be helpful to do a quick review. I think there are some brilliant messages here, but at the same time, I think this is a prime example of having to look more closely at statistics and question what's presented. First let's look at some of the key points:

- Linear systems are not sustainable (and certainly cannot support exponential growth). You need a cyclic system in order even have a chance.

- Externalizing costs is a model which offsets the factors of production to keep costs low (and like over utilizing any resource is itself unsustainable).

- The three R's are Reduce, Reuse, Recycle (in that order). Recycling should actually be a last resort from a sustainable consumption perspective.

For instance, Anne Leonard states that 99% of everything we consume is disposed of in 6 months. That's a lot. I have a general heuristic for these types of scenarios. If your statistic produces a result of more than 90%, that generally means there is some selective data mining going on. To reach a number like 99%, it suddenly becomes more interesting as to define what is the 1% that we keep beyond 6 months. It seems pretty astronomical, yet something about this doesn't seem right. What could possibly justify this number?

- Why six months? Why not look at a quarter? A year?

- Is it measured by income dollars spent? Mass of goods? Volume occupied in a landfill versus in storage?

- What's included? Housing, food, gasoline, seasonal clothes, books, text books per semester, garbage?

- What would be a more appropriate number given the same metrics? What should we aim for?

I am very opposed to peak to trough comparisons in behavioural studies because they represent extremes. I'd be more impressed with a normalized study over time with standard deviations rather than an opportunistic snapshot of a scenario 50 years earlier. This is because I'd expect that despite the growth of consumption, there is a corresponding diminishing utility that Anne hints at as a cause of decreased happiness since the 50s.

Her point on computers and planned obsolescence is both correct in many respects yet highly oversimplified and as a result (I would suggest) misleading. She implies that a computer upgrade is simply a CPU replacement and that companies intentionally design chips so that they cannot be easily substituted.

Upgrading a computer can *sometimes* be as simple as replacing a chip, but often with increases processing power come increases in bus speed and memory. A computer system is a much more complicated than simply replacing an old chip with a newer, better one. It's not just a matter of "shape" as suggested. Actually, the change in shape is deliberate to prevent people who don't understand how computers work from blindly substituting in parts (and destroying both).

Despite my negative tone regarding her use of statistics, I really think Anne has done something phenomenal. Her attempts to reach a broad audience are successful, but she does sacrifice a bit of credibility for accessibility. Some of her broad and extreme claims leave her work more vulnerable to criticism than it should be. I do like her proposed solutions, but I think the corresponding required change in consumer behaviour will be quite a challenge. I think that everyone should spend the just 21 minutes and watch this video.

Tuesday, April 14, 2009

Selfish Sustainability - Save or Starve pt 3

While our hotel was able to improve the situation for the local populace, as I mentioned towards the end of part 2, this acts only as a starting point for those who are concerned about the broadest picture:

Migration Patterns and Shared Responsibility

One of the challenges we face is that although individual countries try to protect what's in their waters, the migration and mating patterns of aquatic life are such that they often move from place to place. While 80% of every aquatic species in the world can be found in the "golden triangle" between Malaysia, the Philippines and Indonesia, each location has different laws and different populaces. While you can protect species in one area, it does you no good if they are being over fished or otherwise destroyed in another. Therefore there is still some unmitigated risk exposure and protection must become a shared responsibility.

This is analogous to many other environmental cases (such as CO2 emissions) as these issues can propagate across geographies and therefore become shared responsibilities.

Market Failure - Dealing with the Black Market Space

The problem with protecting an endangered species is that because it is so rare, it also becomes valuable (think of an inelastic and weak 'supply' curve otherwise known as the species' population - supply push 'inflation'). As a prized fish suddenly becomes more rare, the market price for capturing and consuming one goes up. The incentive to find and catch one goes up as well. The only 'counter balance' is that they become harder to find, but that is hardly any real reconciliation.

When asked what was your definition of endangered, a colleague of mine remarked: "Anything that humans take out of the sea that they don't put back." This idea of a linear relationship with our natural resources won't hold because our population and consumption is growing exponentially. Linear relationships cannot support exponential ones without some form of crash as the inevitable conclusion.

Destroying - Much easier than creating

Destroying (or depleting) a natural resource is *much* easier than creating or renewing one. And there are *many* more people destroying than creating. It takes only moments of carelessness to destroy a coral bed, but years to have it grow back (even with modern technology).

Accelerating the systematic entropy and decay is a disaster. Externalizing the costs is a neat way to offset your responsibility, but it is an unstable model who's destiny is to collapse (with dire consequences).

Sustainability and competition for resources is one of those types of problems that will inevitably come up on the radar if it hasn't already. Basic science and economics dictate that it is coming and we need to pay attention to these issues.

Monday, April 13, 2009

Kickstart - How Successful Canadians Got Started

Canadian talent usually tends to be understated, and these authors venture out to learn from successful Canadians and how they got their start in life. Many of us can sympathize with (or are currently experiencing) the concept of a quarter-life crisis, the idea that we have reached a point in our lives where we are re-evaluating how we want to apply ourselves and the directions we want to set.

Each personality has a different definition and vision for how they apply themselves and what they want to achieve. There are a broad range of experiences, each with its own lessons for any reader. Interestingly, one's "key to success" could become another's potential road to disaster.

I think the book's structure makes it both interesting and easily digestible. It certainly feels as if each story is like sitting down for a coffee with the interviewee. The biographies are divided into three groups: Searchers, Survivors and Dreamers, and each story reflects the Canadian perspective and highlights how our unique backgrounds can help (or impede) our path to success (whatever form it takes).

A must read for young Canadians, especially those of us about to (or who have recently) come out of university and are dealing with the quarter-life crisis. The three authors are friends of mine from high school and (as the introduction suggests) are currently facing the same challenges that we all are.

Sent from my BlackBerry device on the Rogers Wireless Network

Saturday, April 11, 2009

Selfish Sustainability - Save or Starve pt 2

Now that we had a "new" mission. We were forced to help change. Not by governments nor regulations, but our own self interest as a profit loving entity. We had to take a new perspective on our goals and extended the scope. Now we were a force of change.

New Problem: Depletion of natural resources

We can't call ourselves a top luxury hotel with pristine nature if the sea bed has been bombed to smithereens. Our natural resources are being depleted in a decidedly unnatural rate. As mentioned in my previous post, we had to understand why.

Salience:

We need to increase the awareness of the damage that's being done to our natural resources with the public. Issues arise that quickly become apparent. This is an illegal activity. You can't just advertise a class for fish bombers and hope you get good attendance.

We also need to address the poverty and danger associated with this negative short term thinking and the negative economic externalities they impose on the local community.

Causality:

Fish bombing is driven by a combination of poverty which is a result of a lack of opportunity, education and awareness in the general local public. It also thrives because of lack of policing due to difficulty to coordinate naval operations with the community.

Architecture:

How should we model our action plan to solve these challenges?

- There is a need to work closely and communicate with the community to educate them and start a community dialogue. We need to educate our society to understand the value of this natural resource for everyone.

- We need to fight the root causes of this destruction and poverty by creating better, higher paying jobs and opportunities for local members of the community. Suddenly, instead of selling a pile of dead fish for a few RM each, you can have wealthy tourists pay you the same amount just to look at them. One of these you can do forever. The other guarantees your children a worse future than what you have now.

- The community needs to be connected to the relevant policing agencies to actively protect our natural resources.

A higher quality resort demanded higher quality service. We had to introduce language classes, service training to give our staff an opportunity to develop into new more fulfilling roles. It was nice to see local hires who saw the resort as a family. No longer simply "changing sheets", they became part of the hotel experience and fellow nature lovers.

Our staff numbers more than doubled from the previous management (which excludes the second island resort), wages and benefits also increased (caused by the increased demand for labour). In one of the arguably best applications of supply side economic theory working in the real world, we demanded more from our team, compensated them better to keep them and they stepped up to the task.

Also, we developed incredible programs such as the Marine Ecology Research Center (MERC) based on leading edge research to restore marine life in the water. We increased the number of PADI certified divers in our resort, making diving equipment and training accessible to our locally based general employees so that they could experience and understand what they were protecting.

We started our own sustainable fish farms and water treatment and recycling systems. As an island resort, we couldn't just hook up to the city mains. Plus our treatment systems were more advanced that those provided by the city. We made an effort to have our values and behaviours reflect our over arching philosophy. We are profiting from nature, so we have to protect our interests.

Long Term Outlook and Lessons Learned:

If you want to use capitalism as a force for good, how can you redirect 'greed and the drive for profits' into a solution for sustainability? Align the corporation with the values of society. Our situation was unique. There was a direct correlation between the health of our environment and our profits. Our environment: Save or starve.

Anyone who is a cynic of corporations will immediately raise their hand and ask "Uh... Shouldn't governments be looking after the natural resources and interests?" Absolutely. But some governments are not as wealthy as others. The unfortunate truth is that many wealthy countries have exploited their natural resources. The remaining ones that are naturally beautiful usually remain that way because they haven't been industrialized (and tend to be poorer). While this isn't strictly always the case, often governments often can't afford to police and protect their resources. Malaysia is hardly unique in this area. They know they have a valuable resource and are working hard to try to find more effective ways of protecting it.

This was a topic of the Asia Pacific Ecotourism Conference (APECO). While corporations may not be the best solution in all cases, it certainly beats the solution of no awareness and no responsibility. There were countless examples of beautiful areas that were ruined because they were neglected. These areas were notorious for exploitation by seemingly less scrupulous individuals who (it turns out) were just looking to feed their families.

There are certainly a lot more issues and complexity that arise from the discussions and further study regarding ecotourism policies, corporate social responsibility and sustainability. This series of posts is intended only as a starting point to illuminate another path for more enlightened discussion:

- Corporations, if used appropriately, can actually be a force for good rather than stereotypical greed,

- Corporations can contribute funds to develop positive programs, real opportunities and supply good jobs, rather than simply act as a source of tax shelter based charitable donations, and that

- Integrative thinking can help you find the surprising nugget of gold in a case where there is a lot of chaotic data and relationships

Selfish Sustainability - Save or Starve pt 1

Corporations are based on greed right? Is there any way to use the drive for profits to enforce ecological sustainability? Turns out there is. One of the reasons I love this case (derived from my experience in Malaysia) was that it started out as a standard vanilla business problem and evolved into something wonderful. Suddenly, evil corporations could be on the side of angels.

Corporations are based on greed right? Is there any way to use the drive for profits to enforce ecological sustainability? Turns out there is. One of the reasons I love this case (derived from my experience in Malaysia) was that it started out as a standard vanilla business problem and evolved into something wonderful. Suddenly, evil corporations could be on the side of angels.If there was ever a case where integrative thinking would lead a corporation to pursue success while preserving the environment, my work with hotel developers in Malaysia would certainly fit the bill. It's a great case study for looking at a problem through the framework, coming up with more interesting questions and reaching a surprising conclusion. Another reason why I like this case is that when you use integrative thinking to look at the broad perspective of what's going on, you can often find surprising answers to your original questions.

Let's look at what happened:

Let's look at what happened:*Initial* Problem Definition: Let's Make Money

Our holding company held several properties. Two key properties were beautiful island resort properties which had unfortunately been left in disrepair. Our Managing Director had seen some great potential for these new island properties to be acquired and developed into boutique luxury hotels to service the affluent Asian and Australian market.

Salience:

Metrics of a hotel are pretty standard. You want to charge good rates and have lots of people come. As I mentioned in my previous post about hotel capacity management, the raw math for making money in a hotel is pretty straight forward.

Causality:

As I also alluded in my previous post, average room rate (ARR) is dramatically effected by quality (real and perceived). Also occupancy (OCC) was greatly affected by market presence. Both of these qualities are strongly correlated to brand equity. Certainly no surprises here.

Architecture:

(Where new problems and interesting challenges start to surface)

One of the reasons I was brought on the team was to bring in an international perspective. Most of the senior staff was composed of local managers who (although talented) had trouble perceiving (and therefore developing and selling) the differences in the international market. Many of our sales agents had a legacy two-star rating of our old services and facilities. So we set up a framework for dealing with those issues:

- Upgrade facilities to match a 5+ star boutique quality with a luxury brand network (such as Small Luxury Hotels or Prestige)

- Leverage network to attract high quality clientele (from outside of local markets - average spend of a visitor to our part of the world was RM2000 (Ringgit Malaysia) or ~$700USD for an entire week long vacation. We were charging $300 USD per night). Relying on the average and status quo wasn't going to work.

- Renew brand equity and highlight natural beauty and proximity to nature as inimitable point of differentiation against other leading international hotels in the luxury space (in the luxury space you have to be exceptionally unique to attract guests)

- Have world class operations to support your brand equity promise of a peaceful, serene resort experience

While services like jungle trekking and scuba diving were available in beautiful places like Sipadan (World class diving site) or jungle trekking in the depths of the Sabah's jungles, we were the only location that was located only a 15 minute boat ride from main ferry terminal in the heart of the capital city and offered both.

Every other hot destination required a minimum 3 hour bus ride. Sipadan also required a flight to Tawau on the other side of Sabah followed by a lengthy boat ride. While they are worth it for those who are "hardcore" (I myself have done these trips) they are hardly easily accessible and require additional days travel. We were isolated, pristine and accessible.

Resolution:

Exploit natural resources, build hotel, make money. Right? Well that would seem to be the natural answer. But if you're livelihood depends on the pristine condition of your surroundings you have to make sure that you look after your natural resources.

There was a problem in Sabah. While rich in natural beauty, like many developing nations, the majority of the population was poor. By Malaysian standards. This resulted in some extremely negative short term behaviour.

New problem: Destructive Fishing

One such example is fish bombing. As an outsider, I thought it was an over exaggerated myth until I experienced it on a trip during a day off.

I was taking some time off with the diving staff so we decided to scuba dive in a reclusive area of the island. With our proximity to the city, we often see fishing vessels of locals. Pump boats, notorious for being illegal vessels (because they can outrun police boats in shallow shoals), are still incredibly common. On our search for a dive site, we passed by one and in my good natured naivety, I waved as we passed by. Unamused, the two fishermen, sharing what is essentially a canoe with a lawnmower engine, eyed me suspiciously before returning to their work. I though nothing of it at the time (whereas my two diving companions apparently knew better).

Our dive was nice, but fairly uneventful, until towards the end, just before we decided to surface, I heard a rather forceful explosion and felt as if someone has punched me in the chest. It was incredibly unsettling. At first I thought someone's tank exploded, looking at my two companions they were fine. I checked my equipment and everything seemed to be in order. When we returned to the surface I was shaken: "Did you hear that? What was that?"

"Fish bombing" came the reply, "probably from those guys we passed earlier." Although the explosion was a good distance away (judging by the position we last left the two fishermen in the pump boat) I had temporarily forgotten the physics of propagating waves in water (water is an exceptionally good transmitter of waves and pressure). The force felt so close, I thought it had to be nearby.

It turns out this "urban myth" is all too real. What happens is that poor fish farmers will create homemade grenades, toss them in the water and cause large vibrations which immediately kill the fish in a large area by rupturing their organs and they immediately float up to the top for a catch which will supply the fisher man with as much as a reported RM4000 for a days work (average salary for Malaysian workers ranges from RM300 to RM1000 per month for skilled or semi-skilled labourers) so that translates into a great deal of money.

The obvious problem is that this indiscriminate form of destruction also destroys corals that took years to grow. Besides being beautiful in it's own right, coral also acts as a home and food supply for many forms of aquatic life and is therefore a critical part of the ecosystem in the water. In recursively applying the integrative thinking framework (Salience, Causality, Architecture and Resolution) the less obvious "secondary" problem that surfaces becomes the primary one. Fishermen are poor and have an good financial incentive to take more aggressive measures to ensure their livelihood (exploiting their future for the present).

Suddenly, not only is a matter of developing the resort facilities, but also the society that the resort exists in. Our problem definition has suddenly become more complicated (and enriching) than "build hotel, make money".

[cont'd on pt 2]

Friday, April 10, 2009

Globalization - Like Graduating from High School to University

Another particular analogy is the idea of grants. Particularly talented individuals get grants to attract them to different institutions. If you're a talented student (especially in a particularly desirable field of study), you get a grant to further your education. If you're a talented company, countries will often try to grant you subsidies or other concessions to attract you to reside within them. Desirable companies like manufacturing operations to boost exports and the balance of trade.

Standards for success increase. Just because you were smart in the previous life is no guarantee for success in the next. In fact, taking that first big step into the bigger world often acts as a wake up call. Immature behaviour which was previously tolerated because of youth and lack of exposure can now get you in big trouble, but at least you now have a much greater awareness and the opportunity to adapt. You have to change your habits and take on more responsibility.

While previous generations could rely on making the jump to a higher level as their ticket to success, an increasingly crowded pool of talent means that this new higher level isn't a point of differentiation: It's now just table stakes (necessary and not sufficient). And if you choose not to make the jump (for whatever reason) it doesn't mean you are insulated from other people who decide to make the jump when you are competing in the same market place. Old jobs that would allow you to start without a certain level of education are slowly requiring that you make the jump to a higher level or be beaten out by others that do. You have to change your habits and gain new skills to succeed.

But you don't have to go it alone. There are support networks at home. You can join up with partners in the new playing field. You can be mentored by those who have gone before you. You can investigate and ask about the potential benefits (and challenges) that await. It doesn't have to be an overwhelming nor insurmountable challenge. But it will be a challenge. And depending on what you invest in it, it could be incredibly rewarding.

The bottom line is that to succeed you have to be good at what you do, take responsibility, and keep improving.

Thursday, April 9, 2009

LISTEN TO ME! Closing the Loop on Corporate Communication

Because of the sheer number of respondents required in order to get an accurate sampling of customer needs, large processes and systems are needed to ensure statistical relevance when looking at customer responses. However, the larger the system becomes, the more distanced and less intimate it becomes, reducing the effectiveness of each contact. Potential customers are very skeptical of corporate surveyors who want to know how they can "serve" them better.

Door to door and phone based solicitation of feed back is dramatically becoming less effective. The models of feedback surveys had started to migrate online. Also the idea of a "middle man" or a intermediary used to collect data is uncomfortable from a privacy perspective as well as the idea that the message is slowly being filtered out naturally (rather than deliberately). Also, with many membership and reward programs in the consumer and retail space, many individual customers are thinking "why can't you just ask me directly?"

With corporations relatively slow to change versus consumer expectations, it seems as if corporations aren't actually "listening".

Therefore, it has become incumbent on PR and Marketing professionals to step up the *relevant* communication. Follow ups are required both to keep contact as well as ensure that feedback is still "alive" in the system. By staying close to the customer, corporations can be more responsive and, as the saying goes in politics, "look busy as well as be busy" doing the work they were prescribed.

Wednesday, April 8, 2009

Malcolm Gladwell's Outliers

Gladwell investigates the story of success and undermines key assumptions in the story of the successful "individual".

He talks about society's overarching design to promote talented individuals and the flawed idea that differences in underdeveloped individuals disappear over time. He contends that rather than dissipate, they actually become amplified.

He recognizes certain key factors of success:

- Hard work - manifested as 10,000 hours cumulatively spent on learning a skill set.

- Complexity, autonomy and a relationship between effort and reward in doing creative work as a measure of how meaningful each hour is

- The effect of power distance and language to affect entitlement and the ability to challenge while asking the right questions

- The benefit of persistence, self education and drive in development

Sent from my BlackBerry device on the Rogers Wireless Network

Monday, April 6, 2009

Cash flow and Queueing Theory: The Lifeblood of Business

CCC = DOH + DOS - number of days payables

- DSO - Days of sales outstanding (Account Receivable collection to cash)

- DOH - Days on hand - how long inventory is held

- Number of days payables - Accounts payable liquidated to cash instrument payments to suppliers

DOH = COGS / Average Inventory [Inv turnover]

Number of days payables = AP / Average day's COGS [AP turnover]

aka: How long is money sitting in any particular stage?

It logically follows that there are several operational strategies companies can use to influence these cycles. Depending on the nature of the business in question, the benchmarks for operations performance will be different, but can still be influenced in several ways:

- Extend / reduce time for collections terms

- Extend / reduce payment terms to suppliers

- Just-in-time / overstock inventory practices

- Aggressive sales practices

- Financing receivables / payables

Looking at this financial model, there is an analogous model which can be taken in queuing theory:

- Throughput - cash flow (as COGS per period)

- Latency - float

- Arrival rate (λ)- incoming cash (AR conversion rate to cash)

- L - Inventory

- Processing rate (μ) - cash output (AP conversion rate to cash)

And queue formulas such as utilization rate?

This formula essentially describes a short term profitability based on your most liquid assets (or an approximation of overall real profit margins). This has similar characteristics as the Current Quick ratio, but differs in that it describes financial performance as a partial derivative with respect to time (shorter term marginal performance - this metric describes the change in liquidity - rather than the current financial position of your liquidity).

While a good measure of liquidity, cash flow can also indicate if there are other problems going on as well. For instance, if cash conversion rates are too slow, that may be indicative of credit problems and possible default scenarios (a topic for another post).

* Quick note, in order for queuing theory to work, you HAVE to assume FIFO accounting (queues are FIFO in nature). LIFO would be better represented by memory stack models (push and pop flows).

Thursday, April 2, 2009

Zeller's New CEO Overly Ambitious

While Mark has his direction and focus in the right area, "supplier relations" and "productivity" (as measured by sales per square inch) will hardly be easy challenges to surmount.

As far as supplier relations go, if Zeller's wants to compete with Walmart, they have a long way to go in terms of cut throat relationships to drastically cut prices that characterize successful discount retailers. Walmart has also had a good head start with "supplier relations" (notoriously so that they've constantly been targeted by activists for having "bullied" suppliers). But worst of all, Zeller's won't have the strategic leverage they can apply against their suppliers for better conditions as their parent company is having financial troubles of it's own. Also their distribution channels are not particularly noteworthy versus other retailers. It's hard to be the school yard bully if you're the skinny and sickly nerd.

In terms of "productivity", it isn't a cause of their woes, it's a symptom of their diluted brand equity. This is the consequence of their brand swaying back and forth and not entirely owning the discount space. Been to a Zeller's recently? In peak hours, there's no one there. Walmart's continue to be constantly packed. The Zeller's brand isn't even bringing people through the door.

Mr. Foote's "sanguine" attitude is encompassing and descriptive: Win or lose, The future looks both hopeful and bloody.

Profit per Employee - Understanding and Quantifying Your Worth

While some jobs may be more easily measured than others (productivity in line assembly work, revenue generation metrics for sales staff, completes in a call center etc) some maybe more difficult to classify.

However, a relatively new and unique model is being proposed based on profit per employee. By comparing the value add by your employment, what is the profit margin that employers are getting based on your current salary. For instance, if you are a a new hire what is the marginal value that the company expects your work to generate? Look at an example:

At a top engineering consulting firm, a junior engineer is hired at a salary of $60k (~$30/h). However, under the supervision of a P.Eng and colleagues, the junior engineer's work is billed at a rate or $80/h. Assuming a 75% engagement rate, the profit the organization is gaining off the junior engineer would be

or 100%

While this example is terribly oversimplified, it should highlight the idea that whatever your salary is, the company you are working for should be benefiting more (otherwise, the incentive to hire you disappears as does your job possibly).

If the value you calculate is completely out of whack (as compared by relevant benchmarks), it could indicate the following:

- You are adding tremendous value to the organization - time for a promotion

- You are under paid - maybe it's time for a move (conversely the organization may need to re-evaluation it's compensation programs)

- The nature of your job has high multiples on return

- The company may have a strategic interest in hiring more people to undertake similar work

- There are external factors at play - this job is attractive for other reasons - scheduling flexibility, intellectual challenge etc

Wednesday, April 1, 2009

Capacity Management - Why Hotels and Airlines Deliberately Overbook

Any seasoned manager in the hospitality industry is familiar with capacity management. In the services industry, maximizing capacity (as services can't be time shifted to other periods, they are either consumed or not) is a great way to increase overall profitability.

Most people would assume that hotels book until they are at 100% capacity and fill all the rooms. They are usually surprised when they find out that the hotel is over booked. How can that be? It's not operationally difficult to track the number of rooms and the number of guests! Let's explore why:

Profitability for hotels, the top two most important metrics for revenue are ARR and OCC (Average room rate and occupancy rate respectively).

Now, many services will try to boost their ARR through marketing, improved services etc, but for this example, let's assumed it's fixed. It's quite obvious that the best way to boost revenue is to increase occupancy (have more people visit).

Now as a hotel you've booked 100% of your rooms. Great right? Well not entirely. Unfortunately, for a variety of reasons, people cancel, have no shows, etc. So your OCC drops from 100% to it's real life value (usually 70-80%). One solution to recover costs is to instigate a cancellation or no-show fee to recover some of the 20-30% of OCC lost (in the form of a 10-50% fee depending on when the cancellation is made).

Now some clever analysts determined that by trying to predict how many people would cancel, it was possible to deliberately overbook the hotel in hopes of boosting revenue. For instance, if 10% of people booking canceled, it is possible to over book the hotel proportionally so that the final result (expected visitors) would be 100% (and you could also charge cancellations the regular fee).

[Target = 100%]

So if you expected 10% of people to cancel (90% show up), and you had 100 rooms, you would book about ~110 guests, expecting only 99 - 100 to show up.

However, this begins to creep into the case most of us are familiar with: more people show up than expected. In this case, the hotel has a problem. For simplicity sake, let's just say that in order to resolve this issue (upgrades, alternate accommodations, loss of good will etc) there is an "all encompassing" penalty cost of Y dollars.

The full revenue cost formula becomes:

- Average cancellation rate can be refined to more by accurately segregating guest demographics to improve accuracy in predictions (is cancellation affected by age, geography, time of year, other consumer qualities)

- "Cost" of overbooking (especially if it's pervasive) can be detrimental to brand quality and could adversely affect ARR (guests feel like the quality of services drop)

- Hospitality is seasonal by nature so assumptions and rules governing overbooking need to change accordingly

- Over booking assumptions for finding alternate accomodations might be prohibative if there are simply no alternates during a "hot" season